Cyprus Tax Reform 2026 - Personal Tax Changes Impacting Payroll

14/01/2026

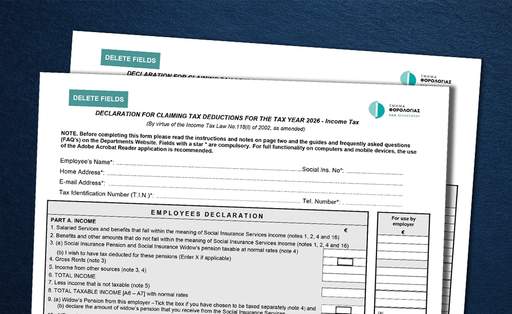

Cyprus’s tax reform effective from 1 January 2026 introduces changes to personal income tax bands and deductions with direct payroll impact.

14/01/2026

Cyprus’s tax reform effective from 1 January 2026 introduces changes to personal income tax bands and deductions with direct payroll impact.

23/12/2025

The reformed tax framework enters into force on 1 January 2026. See the key measures introduced.

17/12/2025

The dates provided are Bank and Public Holidays in Cyprus.

15/12/2025

Payroll is often viewed as a repetitive administrative task. In practice, it has developed into a function that requires constant attention to tax rules, employment legislation, and regulatory updates.

28/11/2025

The extension concerns the company tax return (TD4) and the tax return for self-employed individuals obliged to prepared financial statements (TD1).

16/10/2025

Our professionals have participated on a 2-day internal training program focused on audit quality.

16/07/2025

Our COO, Neophytos Sofocleous, has recently represented PGE&Co at a global conference in historic Cambridge, UK.

14/07/2025

Cyprus introduces a simplified VAT regime for SMEs which, among other, allows for cross-border VAT exemption under certain turnover thresholds.

31/05/2025

All taxpayers with related party transactions have to submit a Summary Information Table

Stay informed about valuable insights as well as regulatory and tax updates